How to invest in times of high inflation?

by Michal Němec / MINEFI, Private Financial Advisor

Where to invest in times of high inflation?

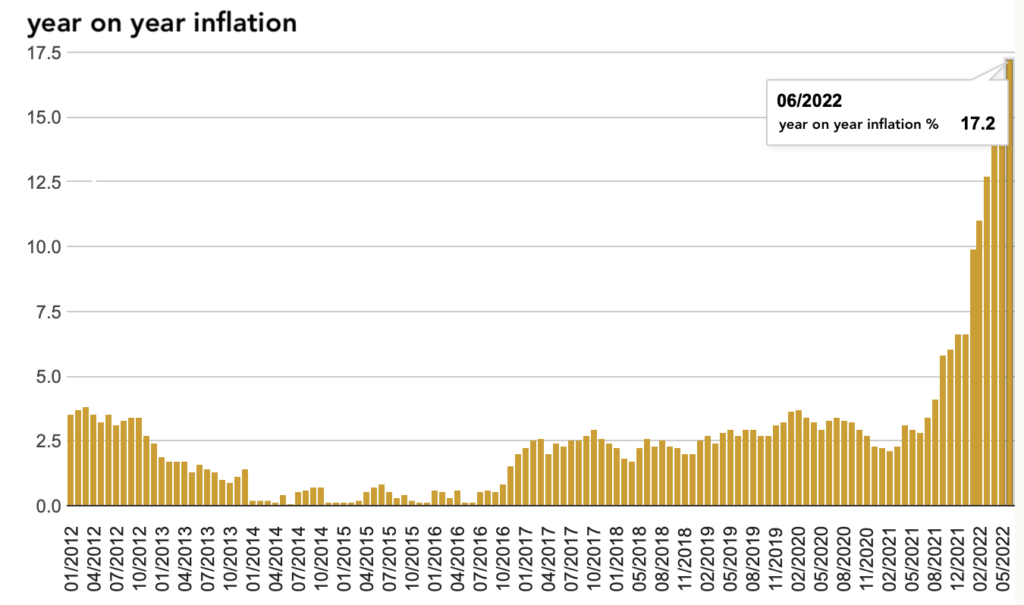

Today, we will look at how to manage money in a situation where year-on-year inflation is 17.2% and our money is losing value in real terms. For consumers, inflation means higher prices for goods and services and the risk of losing purchasing power. From an investor’s perspective, inflation can be seen as another form of taxation, where another part of our earnings has been taken away from us. Consumer prices increased by 1.6% month-on-month. This development was mainly driven by higher prices in the housing and food and non-alcoholic beverages sections. Year-on-year, consumer prices rose by 17.2% in June, 1.2 percentage points higher than in May.

So how can we mitigate the impact of inflation on our savings?

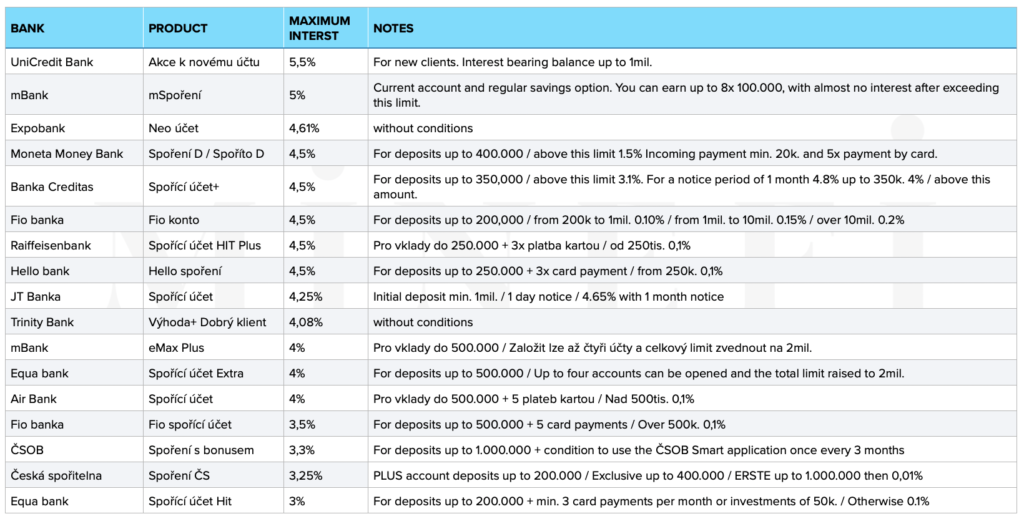

In the first place, many of you will think of savings accounts at banks, they are safe, easily accessible and if necessary one can withdraw money at any time. Where does your bank stand and are there suitable alternatives to these savings accounts? Yes, but let’s start with an overview of what each bank offers.

Banks are sitting on a huge amount of money these days, so nothing is forcing them to sharply increase interest rates on savings accounts. What can a bank do with money from customers? Ideally, it can lend it out, but the situation today is such that property prices are reaching dizzying heights, mortgage interest rates are too, and it is much harder to qualify for a mortgage loan. So the bank takes some of the money from clients and puts it in a deposit account with the Czech National Bank. Currently at 7.7% p.a. which is the prevailing 2T repo rate. Here we come to the first investment opportunity. How would you like to do the same as your bank and put your money in a deposit account? This option consists of investing in a fund or opening a property account that directs your money to a deposit account at the Czech National Bank. Of course, it’s not free and the investment company will take its cut of the expected return, but it’s still a more interesting appreciation than is normally available in savings accounts. As of today, a client with such a product will achieve an appreciation in the range of 6.25 – 6.6% p.a., the notice period is a maximum of two weeks and interest is credited to the client once a month. You can open such a deposit with an amount starting from CZK 10,000.

The disadvantage of this solution is that its profitability is closely related to the rate of interest announced by the Czech National Bank. As soon as rates start to fall, the return to the client will also fall. However, we do not expect this to happen in the coming months. Are you a client who wants your money to appreciate in value over the long term yet with a reasonable level of risk?

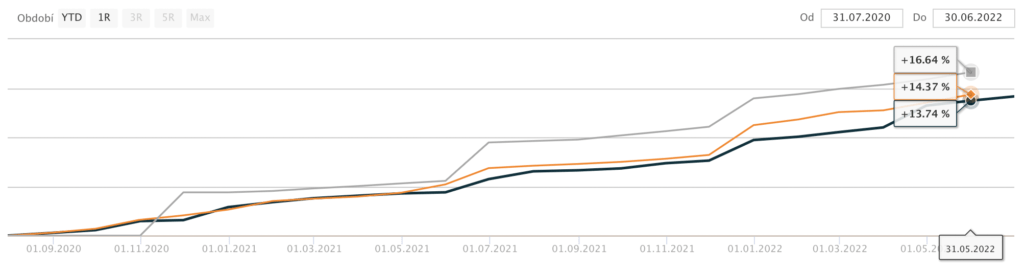

We choose carefully selected real estate funds for our clients’ portfolios. A real estate fund is in these days an alternative to outright ownership. In the past, many clients have purchased apartments for rental purposes. However, there are certain concerns associated with this, whether it be maintenance concerns, communication with tenants, income taxes, etc. In addition, at this time it is not easy to find a suitable property with a reasonable price and also a tenant who will be willing to pay in such an amount that you as the owner will also have something left over. So imagine putting money into a property fund, becoming co-owner of a few dozen properties and receiving a share of the rent collected. There are over 30 real estate funds on the Czech market, but you also need to choose very well among them. You certainly don’t want a fund that is focused in one direction only, such as offices (in case of the next wave of home offices) or a fund that generates income primarily from the appreciation in value of the properties it owns (in case the real estate bubble bursts and prices fall). Conversely, you might like a fund that generates an annual return on the rent collected. Such funds generate a steady profit of 6-10% p.a. regardless of whether there is a covid or ongoing war conflict in Ukraine. The maximum notice period for these funds is six weeks. For interest, we will show you three real estate funds from our clients’ portfolios and their results over the last two years. Note that none of the funds were in a slump.

Even today, there is a plenty of ways to invest, but more than ever, not all of them are always suitable. Our job is to protect the value of our clients’ assets without taking undue risk. For such clients, the above options are the best available today. If you have a longer investment horizon (over 1 year), the options are even more varied and the expected return is higher (in the order of over 8% p.a.) Many clients ask about the possibility of investing in the arms industry, some are attracted by commodities such as oil and gas, others demand shares in large technology companies (Apple, Microsoft, Google, Meta …). There are investment opportunities for all of these areas and we will be happy to introduce you to them.

Author: Michal Němec / MINEFI, Private Financial Advisor

Office Ostrava: Masarykovo náměstí 38/21, 702 00 Ostrava

Office Opava: Beethovenova 2, 746 01 Opava

phone: +420 608 362 986

email: nemec@minefi.cz

web: www.minefi.cz